Try the OmniChroma Family

Try a free sample of OMNICHROMA, OMNICHROMA Flow, or Flow BULK and see how one-shade composite can simplify your restorations.

Volunteer Opportunity

The New Jersey Dental Foundation invites NJDA members to make a meaningful impact alongside TeamSmile and Colgate during the ShopRite LPGA Classic on May 29, 2026. Volunteer at the Seaview Hotel in Galloway, provide essential dental care to children in need, and earn 4 CE credits for your service.

Seller's Event | Bank of America

Planning your next chapter? This seminar is designed for established doctors, offering expert guidance to help you confidently transition your practice and prepare for retirement. Food and beverages provided.

Help Patients Find You

The new AccessCare Directory, made possible by CareCredit, highlights NJDA member-dentists who offer special services such as sedation, homebound treatment, senior discounts, and more. Get on the list!

The Wellness Summit

This intimate summit brings together dental professionals from across New Jersey for expert-led sessions, interactive discussions, and movement-based breaks focused on well-being, resilience, and burnout prevention. Attendees will gain practical tools to support their mental, emotional, and physical health in a supportive, judgment-free environment.

Renew Your Membership

Keep your support and member resources through 2026.

REGISTRATION OPEN!

We are excited to announce that NJDA's Annual Convention will return to Bridgewater on May 1-2, 2026! Registration is now open for this 2-day Convention that will truly be the place to be for all New Jersey dental professionals!

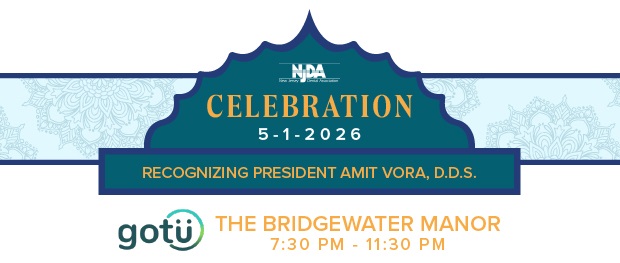

Celebrate NJDA President Dr. Amit Vora

Our yearly NJDA Celebration will cap off Day 1 of the Annual Convention and will take place at the Bridgewater Manor, located just seven minutes from the Convention site. We'll be celebrating New Jersey dentistry and our guest of honor, President Dr. Amit Vora. RSVP to join the celebration!

Enhance Your Membership

Customize your 2026 membership by adding the virtual License Requirements Series, our Practice Solutions bundle, or the new Dental Impact Series!

Helping Members Succeed

The New Jersey Dental Association is the voice of the dental profession and a strong proponent of oral health in the state. Members are part of a vibrant community of dentists encompassing 12 local dental societies as well as the American Dental Association. Members engage in educational programs, have access to dentist-centric relationships and tools to navigate the business of dentistry and their careers, as well as benefit from dedicated advocacy that protects the interests of the profession. The organization is run by member-dentists with the support of a team of professionals at NJDA Headquarters. NJDA members never practice alone!

UPCOMING EVENTS

DENTAL NEWS AND NOTES

Interest Rates & You

Dear Diana: I've been an associate dentist for about three years now. When I first began my career, inflation wasn't on my radar, and I was happy with my financial situation. One mantra that has helped me show fortitude during challenges is "prevention is better than a cure." Now that the cost of everything is rising, I want to revisit my finances to adapt to the new reality. What do I need to know about loans and rising interest rates? — A Warrior, Not a Worrier

Dear Warrior: Preparing yourself for the future is a very smart move, and inflation can be a cause for concern, but there are several ways to protect yourself. As the government adjusts the federal funds rate, banks follow suit to amend their lending rates. Let's dive into some measures you can take to mitigate the added expenses that rising interest rates can create:

Adapt the debt snowball approach

List all the debts you have. The debt snowball method is a debt-reduction strategy that helps you focus on paying off your small debts first before moving on to larger ones. Make sure you are paying your small and high-interest-rate debt first, as that will help you save those extra dollars for your other loans. You can also consolidate your high-interest debts into a loan that has a lower interest rate.

Pay more than required

The best way to ensure you’re managing your debt in a rising-rate environment is by making higher payments that pay down your principal faster. This can save you on interest over time. Cut down on your expenses, if possible, and apply those savings toward your loan payments.

Know your loan type: variable rate or fixed rate?

Beware of the type of loan you currently have or are planning to take. A fixed interest rate has the same interest rate for the entirety of the borrowing period, whereas a variable interest rate changes with fluctuations in the market. Your banker can advise you as to which loan structure is in your best interest. Do ask about refinancing options if you have a variable-rate term loan.

Keep your financing options open

There are several lenders out there, so do your homework and shop around for a competitive interest rate. Remember that a best rate might mask benefits available at a slightly increased rate, such as the ability to obtain 100% financing. Find a lender with expertise working with health care professionals. It’s their job to know the market and help advise you as to your financing options.

Diana Talpa works with privately held companies to consistently deliver innovative, industry-specific financing and cash management solutions to meet their diverse needs. As a vice president in commercial banking at BMO, she leverages her background in business valuations, financial analysis and commercial credit underwriting to add value, foster long-lasting relationships and — above all — help dentists realize their vision for practice success.

Contact Us

Phone: 732-821-9400 or dial the Staff Directly

Fax: 732-821-1082 | Email: info@njda.org | Follow us @NJDentalAssoc

One Dental Plaza, North Brunswick, NJ 08902