Thinking About Selling your Dental Practice? What to Expect in Net After Taxes

If you are thinking about selling your dental practice, one of the considerations is the “timing.” In other words, when do I place my dental practice on the market? When my clients ask me this question, I ask the client, “When would you like the sale to take place?” Most respond, “yesterday.” But, “Seriously,” I ask them, “when would they like to be done with Dentistry?”

Once we determine the date, we then work backward. I tell the client it could take up to a year to sell a dental practice. For example, if you would like to sell by June 2026, I suggest you place your dental practice on the market by June 2025. Please keep in mind, you should consider the time to engage a reputable dental broker, acquire any necessary technology you feel will enhance the sale, as well as consider “sprucing” up the office prior to its sale.

Once we determine the date, we then work backward. I tell the client it could take up to a year to sell a dental practice. For example, if you would like to sell by June 2026, I suggest you place your dental practice on the market by June 2025. Please keep in mind, you should consider the time to engage a reputable dental broker, acquire any necessary technology you feel will enhance the sale, as well as consider “sprucing” up the office prior to its sale.

Another consideration is timing of the sale. Would you like the sale to take place in the current year, or would you prefer the sale to take place on January 2, 2026?

Depending on the date you chose, the taxes on such sale will be due for that particular calendar year. For example, if you sell your practice on or before December 31, 2025, the taxes as a result of the sale would be due on or before April 15, 2026.

Minimizing the “Tax Costs”

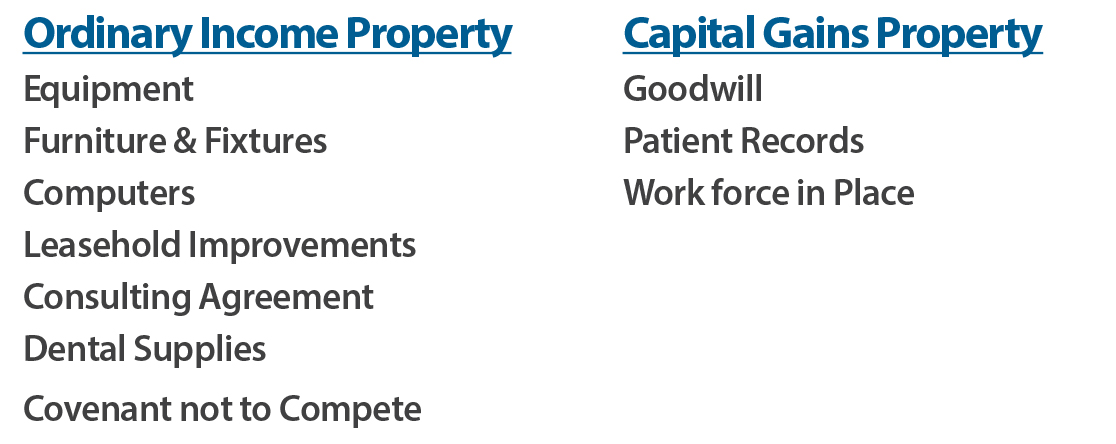

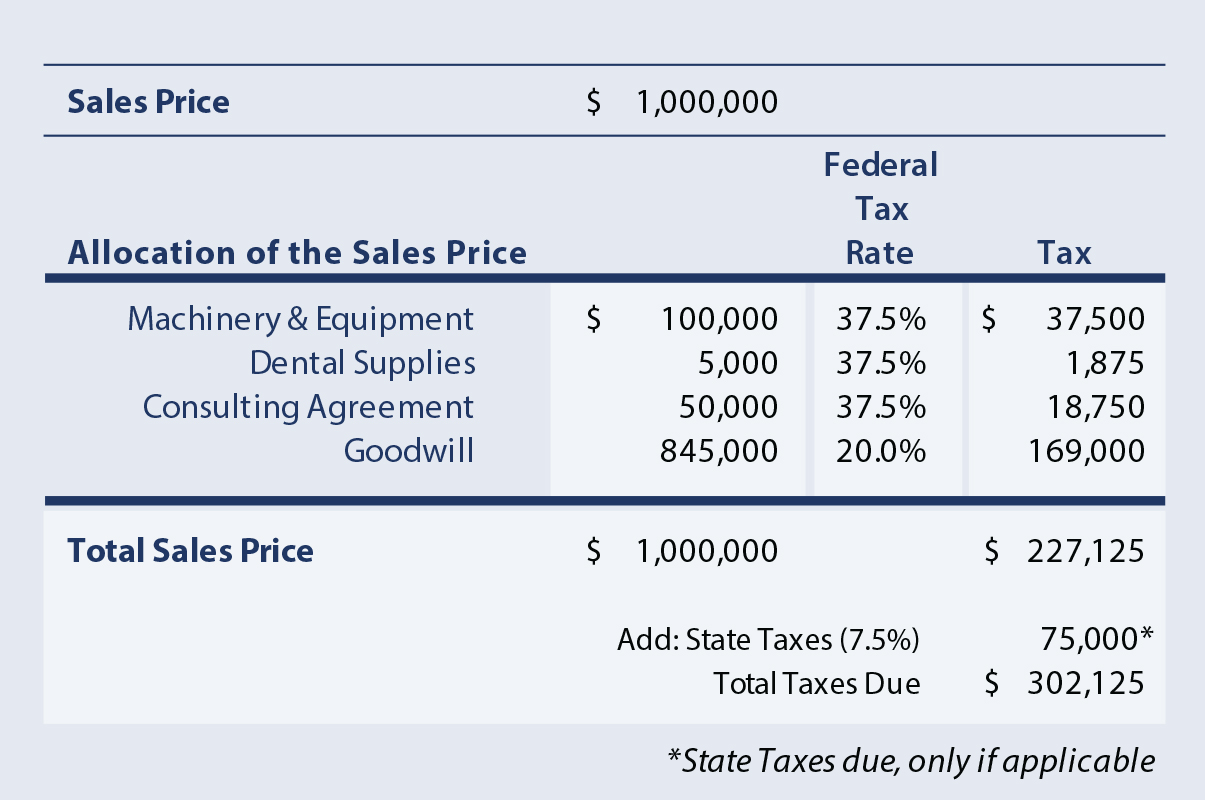

Please keep in mind, the Internal Revenue Service (IRS), has a “pecking” order by which they allocate the sales price of your dental practice. The order of allocations starts with the “Hard Assets” and concludes with the final allocation with the “Soft Assets.”

So, using the above list as a guide and your knowledge of how to allocate the sales price to your benefit as a seller (in order to minimize the income taxes as a result of the sale), a majority of the sales price would need to be allocated to the “Capital Gains Property” assets as opposed to the “Ordinary Income Property.”

Below, I will demonstrate the potential “tax costs” associated with the sale of a dental practice at $1,000,000.

As you can readily see above, the “tax costs” are approximately 30% of the sales price of $1,000,000 ($302,125 / $1,000,000). The more of the sales price is allocated to Ordinary Income Property, the higher the tax costs to the seller.

Please keep in mind, the buyer wants more of the allocation to Ordinary Income Property as opposed to the Capital Gains Property that the seller desires. So, ask yourself, why does the buyer want more allocated to Ordinary Income Property? The Depreciation / Amortization chart below will help you understand why this is the case.

For example, the buyer wants a majority of the sales price allocated to the equipment, because it can be written off (expensed / depreciated) over five years as opposed to goodwill which will be amortized over fifteen years. As a dental broker, we are often called upon to help negotiate the allocation of the sales price, so that it is fair to the seller as well as fair to the buyer.

Internal Revenue Service (IRS) Requirements

When you sell a dental practice, the IRS requires both the buyer and seller to disclose it in their income tax returns in the year of sale. The information disclosed is: who is the buyer, who is the seller along with the sales price and how the sales price was allocated. The IRS form to complete is IRS Form #8594, Asset Acquisition Statement under IRS Code Section 1060.

In addition to the information as noted above, the IRS will ask questions on Form #8594, such as: Did the buyer and seller agree to such allocation? If so, it is important for both the buyer and seller to check the “yes” box.

Concluding Thoughts

There could be significant tax costs associated with the sale of your dental practice. It is important to engage a reputable dental broker to assist you with some of these finer details in order to avoid unnecessary tax costs that may arise as a result of a poor allocation of the sales price.